Top 5 Option Strategies

There are only 3 senarios of stock movement that it goes up or down or remain steady.

It is possible for trader to profit from all scenarios by operating multiple instruments in a right combination. The following are the common stratgies in options :

1. Short Strangle

A short strangle consists of one short call with a higher strike price and one short put with a lower strike. Both options have the same underlying stock and the same expiration date, but they have different strike prices. A short strangle is established for a net credit (or net receipt) and profits if the underlying stock trades in a narrow range between the break-even points.

| Item | Description | |

|---|---|---|

| 1 | Max Profit | Profit potential is the total premiums received - commissions. |

| 2 | Max Risk | Basically unlimited on both upside and downside. For the downside the loss capped when the price of underlying asset becomes zero. |

| 3 | Option Legs | 2 legs |

| 4 | Time Effect | Positive that potential profit increases with time passing. |

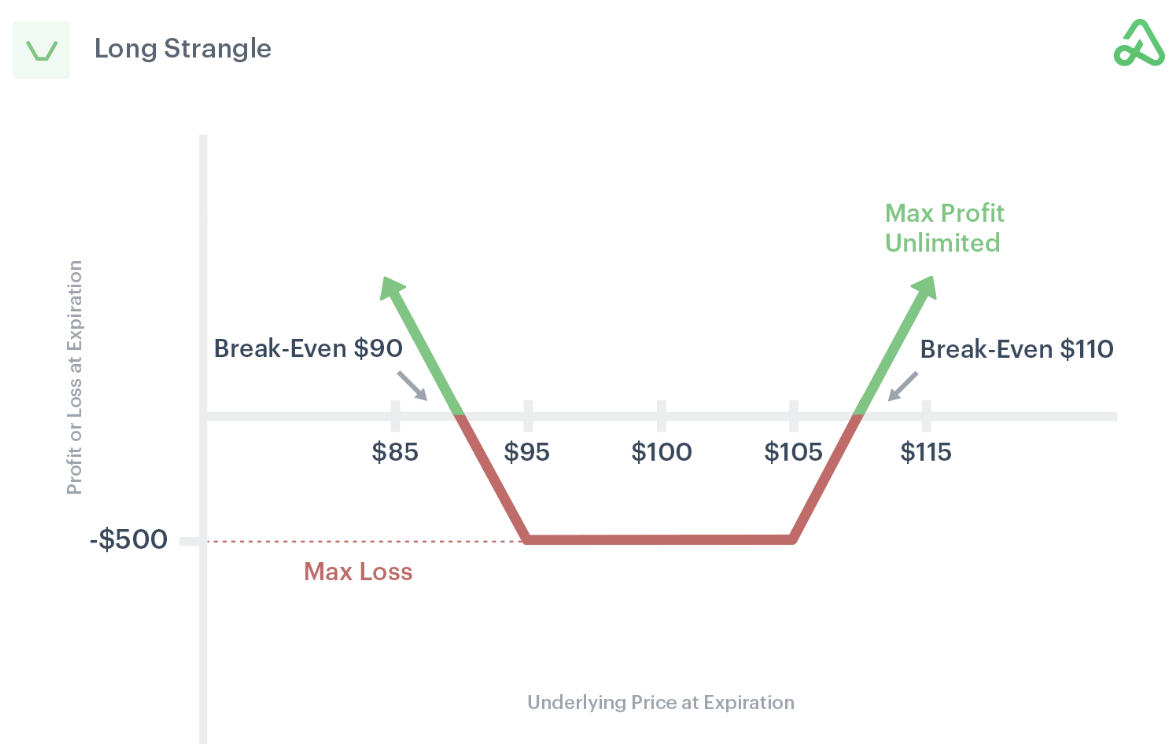

2. Long Strangle

A long strangle is made up of a long call option and a long put option purchased out-of-the-money with the same expiration date. The combined cost of the long call and long put defines the maximum risk for the trade.

| Item | Description | |

|---|---|---|

| 1 | Max Profit | Profit potential is unlimited |

| 2 | Max Risk | Max loss is the premium |

| 3 | Option Legs | 2 legs |

| 4 | Time Effect | Positive that potential profit increases with time passing. |

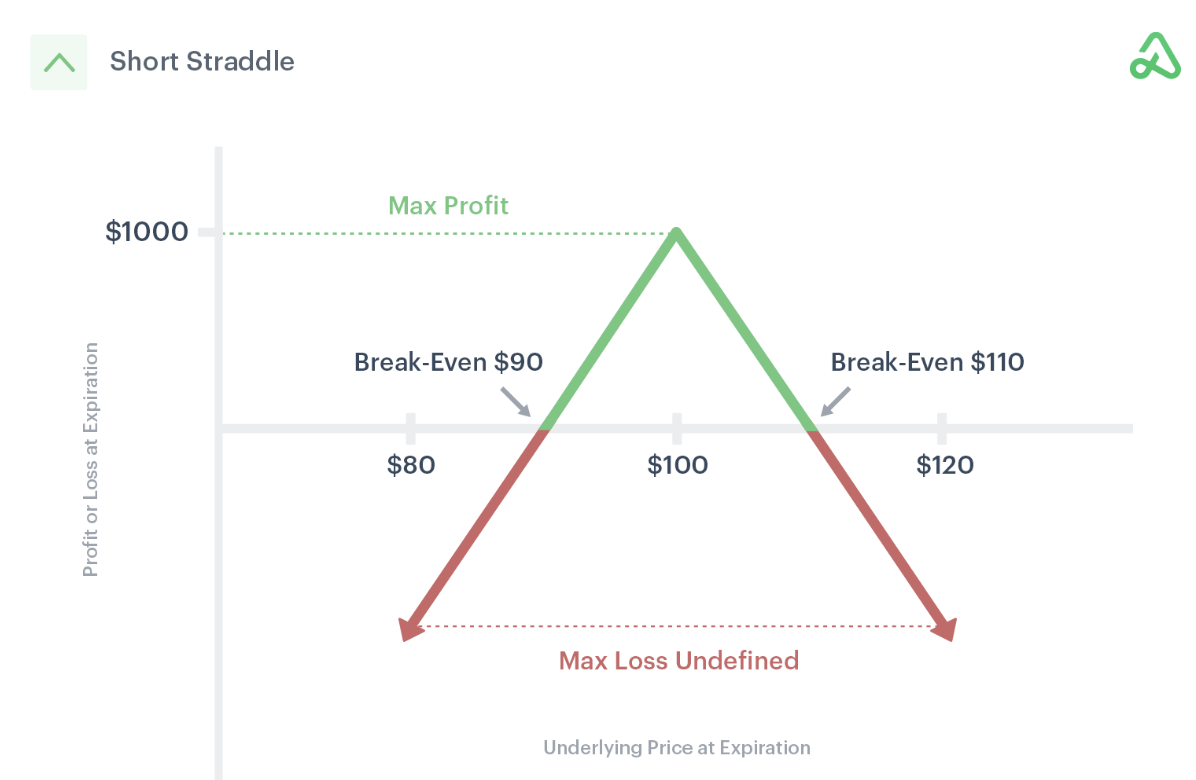

3. Short Straddle

A short straddle consists of a short call option and a short put option with the same strike price and expiration. Short straddles are typically sold at-the-money of the underlying asset. However, a short straddle can be opened above or below the stock price to create a bullish or bearish bias.

| Item | Description | |

|---|---|---|

| 1 | Max Profit | Profit potential is limited to the premium. |

| 2 | Max Risk | Unlimited loss |

| 3 | Option Legs | 2 legs |

| 4. | Time Effect | Positive that potential profit increases with time passing. |

4. Long Straddle

A long straddle consists of a long call option and long put option centered at the same strike price with the same expiration. Long straddles are typically purchased at-the-money of the underlying asset. However, they can be set up above or below the stock price to create a bullish or bearish bias.

The combined cost of the long call and long put define the maximum risk for the trade. The long straddle will capitalize on a large move in either direction and/or an increase in implied volatility. The potential profit is unlimited beyond the debit paid to enter the trade.

Long straddles benefit when implied volatility increases. Higher implied volatility results in higher option premium prices. Ideally, when a long straddle is initiated, implied volatility is lower than where it will be at exit or expiration. Future volatility, or vega, is uncertain and unpredictable. Still, it is good to know how volatility will affect the pricing of the straddle options.

Time is your enemy = Long straddles lose value as time passes.

| Item | Description | |

|---|---|---|

| 1 | Max Profit | Profit potential is unlimited. |

| 2 | Max Risk | Limited loss as if the price is not moving at all, you loss all premium |

| 3 | Option Legs | 2 legs |

| 4. | Time Effect | Negative that potential profit decay with time passing. |

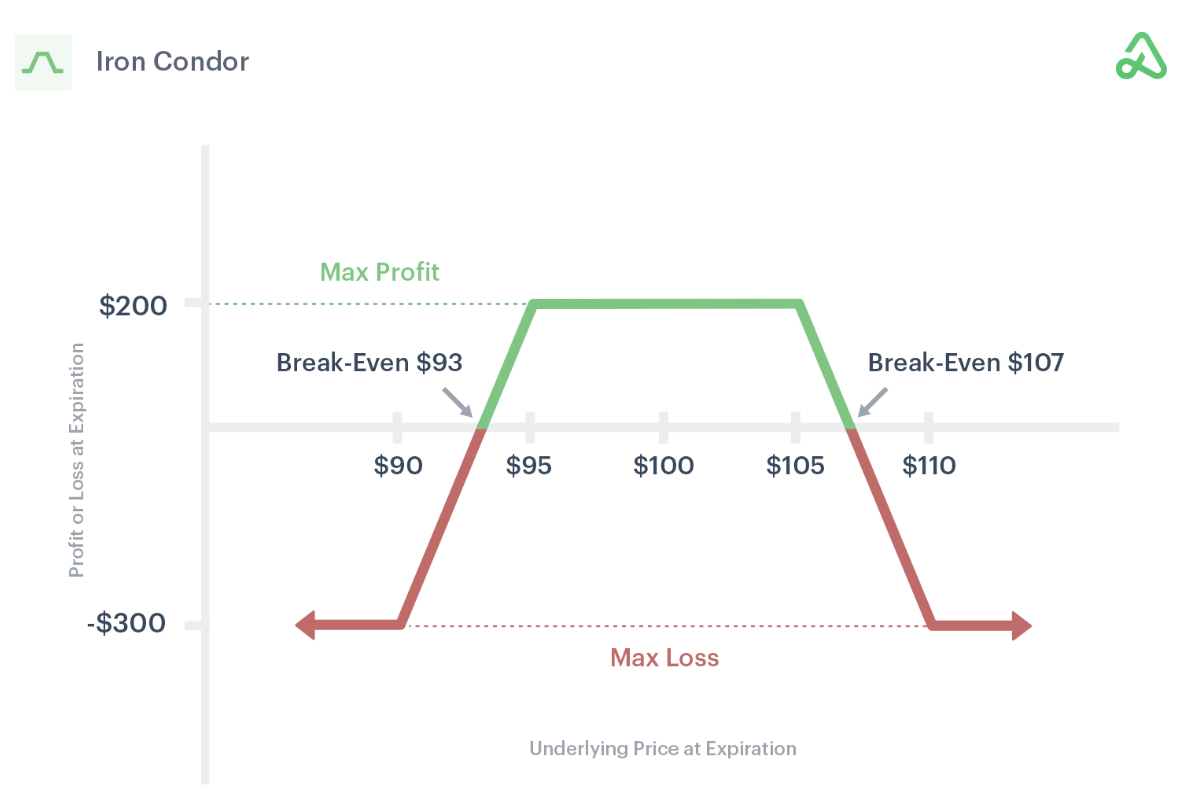

5. Iron Condor

An iron condor consists of selling an out-of-the-money bear call credit spread above the stock price and an out-of-the-money bull put credit spread below the stock price with the same expiration date.

-

selling a call option and purchasing a call option at a higher price.

-

selling a put option and purchasing a put option at a lower price

The strategy looks to take advantage of a drop in volatility, time decay, and little or no movement from the underlying asset. Iron condors are essentially a short strangle with long option protection purchased above and below the short strikes to define risk.

| Item | Description | |

|---|---|---|

| 1 | Max Profit | limited. Profit is the total premiums received - commissions. |

| 2 | Max Risk | limited. |

| 3 | Option Legs | 4 legs |

| 4 | Time Effect | Positive that potential profit increases with time passing. |

Reference