Economic Weather x All Weather Portfolio

The sky has its weather, so as the economics. The idea is proposed by Dalio and Bridgewater that they framed these four economic environments as follow

-

Growth Rising

-

Growth Falling

-

Inflation Rising

-

Inflation Falling

All Weather Portfolio

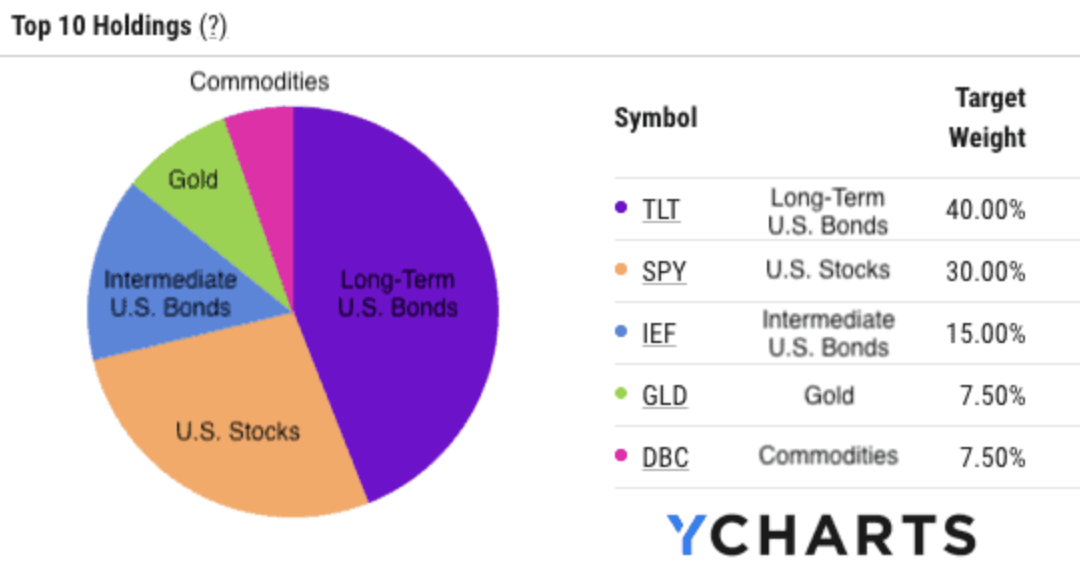

So how to build a roboust investment portfolio? Since every asset performs differently based on what is happening in the macro-economic enviroment. We could distributed our portfolio into a weightage combination. The All Weather Portolio is thus proposed.

For example : In periods of rising growth, stocks tend to do well and during periods of falling growth, bonds tend to do well.

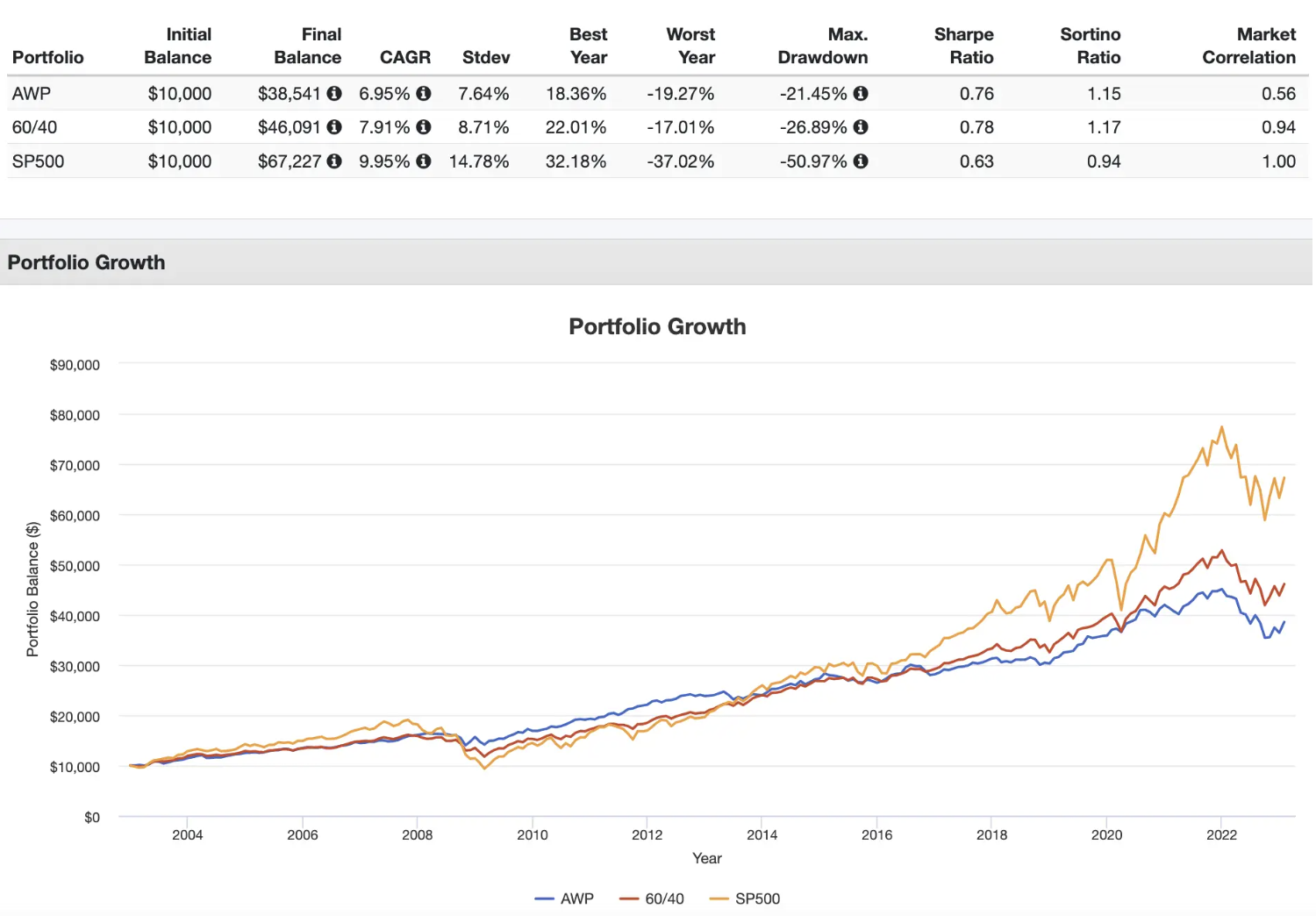

However, it is important to notice that Just like any hedge strategies, there is always trade-off between risk and reward. That if you compare simple SP500 vs All weather portfolio(AWP) on multiple metrics. In Max Darwdown, AWP performs better but in turns of actual gain / Final balance, the SP500 is the best.

Key Take Away

All weather portfolio is providing a simple concept and though process that we can build the portolio against the uncertainty. From view of machine learning, it is more like a linear model. By leveraging advance modeling, we can expect lots of rooms of a more dynamic structured product.

Ref